- 2 Growth Stocks That Could Rocket Higher in 2025: Are They Right for Your Portfolio?

- Dogecoin’s Remarkable Surge: Large Transaction Volume Spikes 41% as Network Activity Intensifies

- Portfolio, FDI inflows likely to rise this year: DEİK’s Olpak

- Retirement Stock Portfolio: 7 Safe Dividend Stocks To Invest In

- Reinsurance Buyers With Good Portfolio Stories See Better Renewal Outcomes: Brokers

In the current climate of cautious Federal Reserve commentary and political uncertainty, U.S. stocks have experienced declines, with smaller-cap indexes facing the brunt of these challenges. As investors navigate this landscape marked by rate adjustments and economic resilience, identifying promising opportunities in lesser-known stocks becomes crucial for diversifying portfolios. A good stock in such conditions often demonstrates strong fundamentals, resilience to economic fluctuations, and potential for growth despite broader market volatility.

Bạn đang xem: Uncovering Three Undiscovered Gems For Your Investment Portfolio

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sun | 14.28% | 5.73% | 64.26% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 34.89% | 3.23% | 3.61% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Top Union Electronics | 1.25% | 6.67% | 17.52% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Chita Kogyo | 8.34% | 2.84% | 8.49% | ★★★★★☆ |

| Union Coop | NA | -4.69% | -14.06% | ★★★★☆☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Click here to see the full list of 4632 stocks from our Undiscovered Gems With Strong Fundamentals screener.

We’re going to check out a few of the best picks from our screener tool.

Simply Wall St Value Rating: ★★★★★★

Overview: Shandong Tongda Island New Materials Co., Ltd. operates in the textile manufacturing industry and has a market capitalization of CN¥1.87 billion.

Operations: Tongda Island generates revenue primarily from its textile manufacturing segment, amounting to CN¥366.51 million. The company’s financial performance is influenced by its cost structure and efficiency in managing production expenses, which impact its profitability metrics such as the net profit margin.

Shandong Tongda Island New Materials, a nimble player in the materials sector, recently reported sales of CN¥276.78 million for the nine months ending September 2024, up from CN¥239.51 million last year. The company swung to a net income of CN¥11.46 million from a loss of CN¥2.03 million previously, with earnings per share at CNY 0.1291 compared to a loss per share of CNY 0.0228 last year. Despite no debt and impressive earnings growth over the past year exceeding industry norms by leaps and bounds (2021%), it faces challenges with declining earnings over five years at an annual rate of 52%.

Simply Wall St Value Rating: ★★★★★★

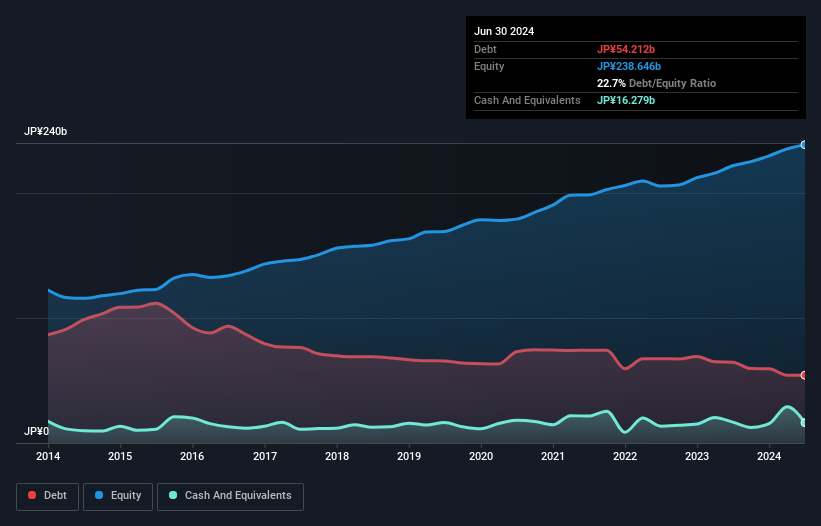

Overview: MEGMILK SNOW BRAND Co., Ltd. is engaged in the manufacturing and sale of milk, milk products, and other food products both in Japan and internationally, with a market capitalization of ¥184.26 billion.

Operations: MEGMILK SNOW BRAND Co., Ltd. generates significant revenue from its Dairy Products and Beverages and Desserts segments, which contribute ¥274.94 billion and ¥260.77 billion, respectively.

Megmilk Snow Brand, a nimble player in the food industry, has shown impressive earnings growth of 44% over the past year, outpacing its peers. Despite a one-off gain of ¥9 billion impacting recent results, their net debt to equity ratio stands at a satisfactory 13%, indicating sound financial health. The company is trading at nearly 27% below estimated fair value, suggesting potential upside. While future earnings are projected to decrease by an average of 4% annually over the next three years, Megmilk’s strategic moves like establishing a Vietnam subsidiary might influence long-term prospects positively.

Simply Wall St Value Rating: ★★★★★☆

Xem thêm : AllianceBernstein Municipal Fund Reveals $370M Portfolio: Healthcare, Texas Lead November Holdings

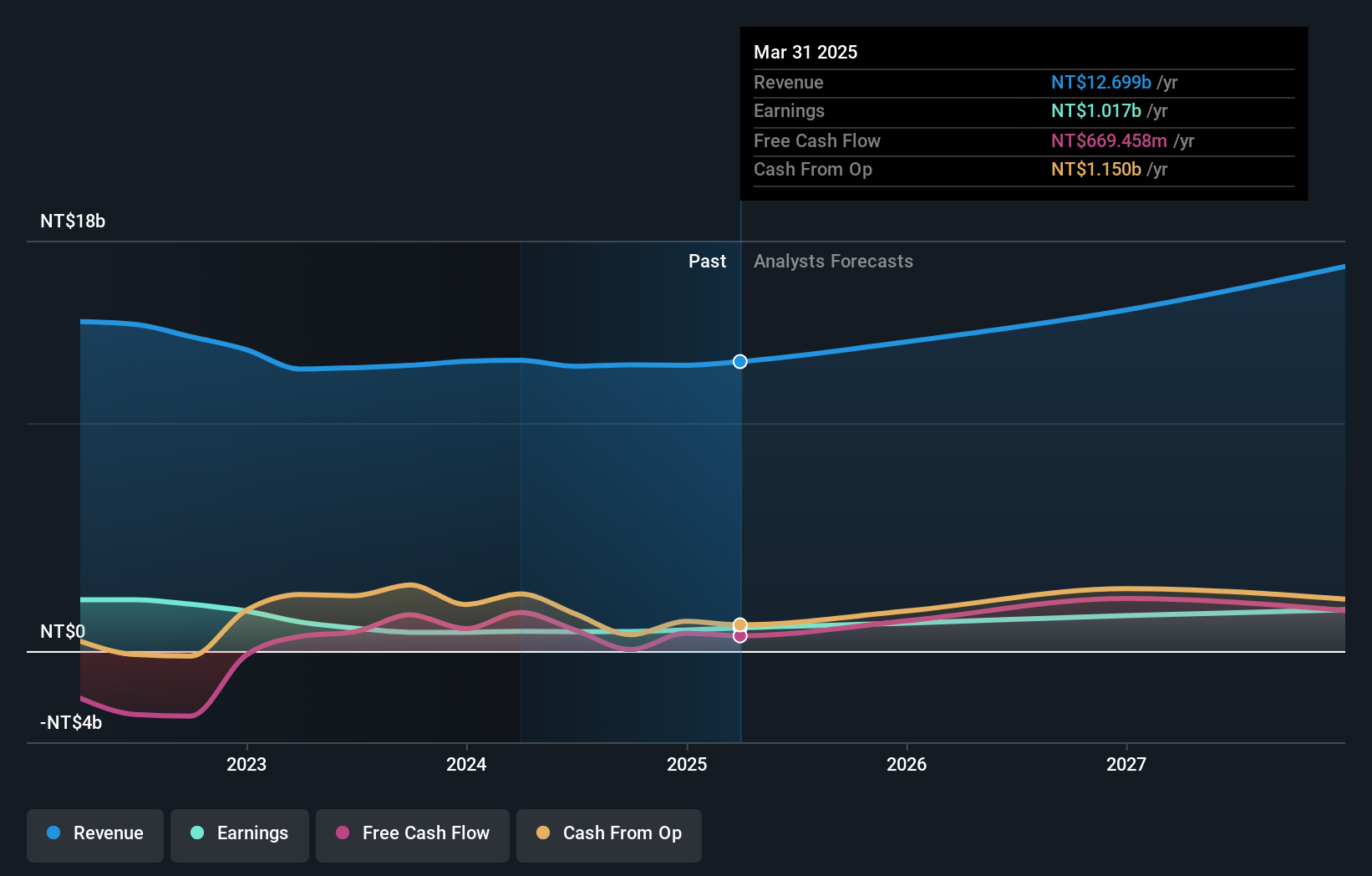

Overview: Panjit International Inc. is a company that manufactures, processes, assembles, imports, and exports semiconductors across Taiwan, China, Korea, the United States, Japan, Germany, Italy, and other international markets with a market cap of NT$19.53 billion.

Operations: The primary revenue streams for Panjit International are Power Split Components and Power Integrated Circuits and Components, generating NT$11.40 billion and NT$943.64 million, respectively. The Solar segment contributes NT$220.88 million to the total revenue.

Panjit International, a player in the semiconductor industry, has shown steady performance with its earnings growing 6% annually over five years. Its net debt to equity ratio improved from 91.6% to 62.7%, indicating better financial health, and interest payments are well covered by EBIT at a strong 33.4x coverage. The company reported third-quarter sales of TWD 3,335 million and net income of TWD 253 million, slightly up from last year’s figures. With a price-to-earnings ratio of 23x below the industry average of 29.5x, Panjit seems attractively valued for potential investors considering its stable growth trajectory.

Where To Now?

Ready To Venture Into Other Investment Styles?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Try a Demo Portfolio for Free

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]

Nguồn: https://earnestmoney.skin

Danh mục: News