- Top 5 Coins Ready To Shift Portfolio Strategies In 2025

- A Well Diversified Portfolio And An 8% Dividend Yield

- Stock market strategy: How to build your equity portfolio in 2025? Here’s a guide

- Grow Your Crypto Portfolio Like a Pro with FXGuys

- The Best 5 Cryptos To Buy Before The Next Bull Market Surge

“A government which robs Peter to pay Paul can always count on the support of Paul.”

Bạn đang xem: Model Portfolios | January Update

– George Bernard Shaw

Happy New Year! 2024 was another excellent year for investors. The S&P 500 Index produced a total return of 25.0%, and the S&P U.S. Aggregate Bond Index increased 1.8%. Our preferred cash vehicle, the Vanguard Federal Money Market Fund (VMFXX) returned 5.2%. The Vanguard Total Stock Market Index Fund (VTSAX) returned 23.7%.

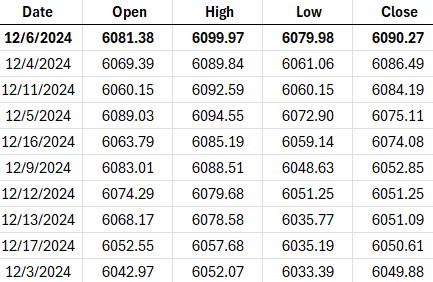

The S&P 500 set numerous all-time closing highs throughout the year, ending the calendar year 2024 about -3.4% below its record-high closing level of 6,090.27 achieved on December 6th. The table below shows the top ten highest S&P 500 Index closing levels, all of which occurred during December 2024:

Looking ahead, our 2025 forecast is for 2% real GDP growth, a deceleration in the pace of inflation toward the Fed’s 2% target level, and a weakening labor market.

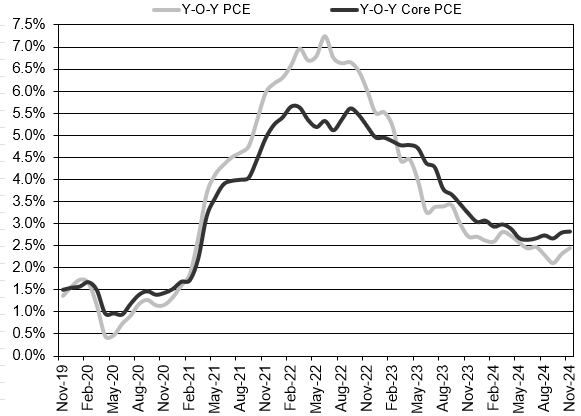

The Fed’s preferred inflation measure is the personal consumption expenditures (PCE) price index. In November, the headline PCE inflation rate was 2.4% year-over-year. The core PCE inflation rate, which excludes the volatile food and energy components, was 2.8% year-over-year in November. The most recent three-month core PCE rate is 2.5% annualized, and the six-month core PCE rate is 2.4% annualized. The three-month, six-month, and twelve-month core PCE inflation figures are above the Fed’s 2.0% PCE inflation target.

Xem thêm : 3 Dividend Stocks To Consider For Your Portfolio

Headline PCE:

+0.1% seasonally adjusted in November, following 0.2% in October

+2.4% year-over-year

+2.1% latest 3 months annualized

+1.9% latest 6 months annualized

Core PCE: (excludes food and energy)

+0.1% seasonally adjusted in November, following +0.3% in October

Xem thêm : Marriott and Delonix Sign Eight Hotel Deal to Boost Tribute Portfolio Brand in China

+2.8% year-over-year

+2.5% latest 3 months annualized

+2.4% latest 6 months annualized

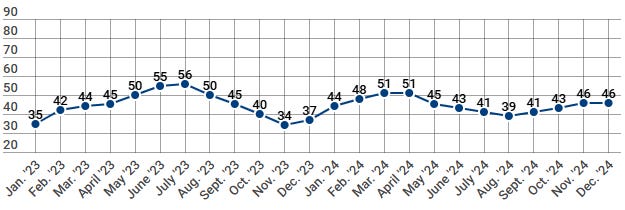

The NAHB/Wells Fargo Housing Market Index (HMI) measures conditions in the single-family housing market. The index was unchanged in December, holding steady at 46. HMI Index readings above 50 are indicative of favorable single-family home builder sentiment. The current sales conditions index was unchanged at 48, with the measure of sales expectations over the next six months rising three points to 66, and the prospective buyer traffic index falling one point to 31. The NAHB Chief Economist noted, “Concerns over inflation risks in 2025 will keep long-term interest rates, like mortgage rates, near current levels with mortgage rates remaining above 6%.”. Regionally, the Northeast was the strongest, rising five points to 62. The Midwest remained at 48, and the South rose six points to 48. The West weakened one point to 38.

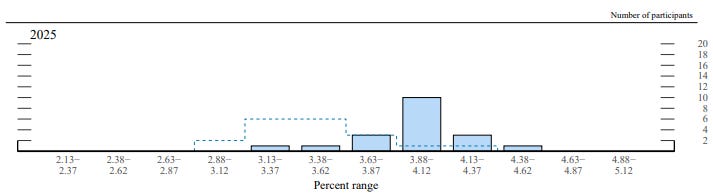

The Federal Open Market Committee (FOMC) is scheduled to meet on January 28th and 29th. We do not anticipate any change to the federal funds rate at the January meeting. The FOMC has the following 2025 meeting schedule: January 28/29, March 18/19*, May 6/7, June 17/18*, July 29/30, September 16/17*, October 28/29, December 9/10*. The asterisk(*) highlights meetings with a Summary of Economic Projections. Here is our summary of the December FOMC meeting.

Below is a chart that shows the distribution of FOMC members’ fed funds rate forecasts for year-end 2025. Most FOMC members forecast two additional rate cuts in 2025, lowering the fed funds rate to the 3.75% to 4.0% target range. Before lowering the fed funds rate, FOMC members will likely want to see further progress toward achieving their 2% inflation target.

Below is the monthly update of the Marketimer and Brinker Fixed Income Advisor Model Portfolios through December 31, 2024.

Nguồn: https://earnestmoney.skin

Danh mục: News