- ‘Am I Playing It Too Safe?’ Reddit Offers Polarized Advice

- PennantPark Floating Rate Capital: Improved Portfolio Quality And Valuation

- EastGroup Properties expands Sunbelt industrial portfolio By Investing.com

- Fidelity Investments Canada ULC announces portfolio management change on Fidelity Women’s Leadership Fund

- Is Boston Scientific Stock a Smart Pick for Your Portfolio Right Now? – January 2, 2025

As global markets navigate a complex landscape marked by resilient labor markets and persistent inflation concerns, investors are increasingly focused on strategies to weather the volatility. With U.S. equities experiencing a downturn and inflationary pressures influencing central bank policies worldwide, dividend stocks present an appealing option for those seeking stability and income in uncertain times.

Bạn đang xem: 3 Prominent Dividend Stocks To Enhance Your Portfolio

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.31% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.36% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.38% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.80% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.72% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.00% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.66% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.89% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.21% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.17% | ★★★★★★ |

Click here to see the full list of 2007 stocks from our Top Dividend Stocks screener.

We’re going to check out a few of the best picks from our screener tool.

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sparebanken Vest is a financial services company offering banking and financing services in the counties of Vestland and Rogaland, Norway, with a market cap of NOK15.72 billion.

Operations: Sparebanken Vest generates its revenue primarily from Banking Operations – Retail Market (NOK3.14 billion), Corporate Market (NOK2.29 billion), Treasury (NOK1.05 billion), Bulder Bank (NOK219 million), and the Estate Agency Business (NOK262 million).

Xem thêm : Analysts put 3 portfolio stocks on their buy lists. Cramer’s takes on each

Dividend Yield: 5.2%

Sparebanken Vest’s dividend payments have been volatile over the past decade, and its current yield of 5.23% is lower than top-tier Norwegian dividend payers. However, the bank maintains a reasonably low payout ratio of 45.9%, indicating dividends are presently well-covered by earnings and expected to remain so with a forecasted payout ratio of 66.9% in three years. Recent earnings growth and strategic debt financing suggest potential for future stability despite higher-risk funding sources comprising 56% of liabilities.

Simply Wall St Dividend Rating: ★★★★★☆

Overview: King Chou Marine Technology Co., Ltd. operates globally under the King Net brand, focusing on the manufacturing, processing, exporting, and importing of fishing nets for marine industries, with a market cap of NT$3.44 billion.

Operations: King Chou Marine Technology Co., Ltd.’s revenue segments include Chin Chou with NT$2.13 billion, Kunshan King Chou with NT$455.15 million, and Vietnam King Chou with NT$830.91 million.

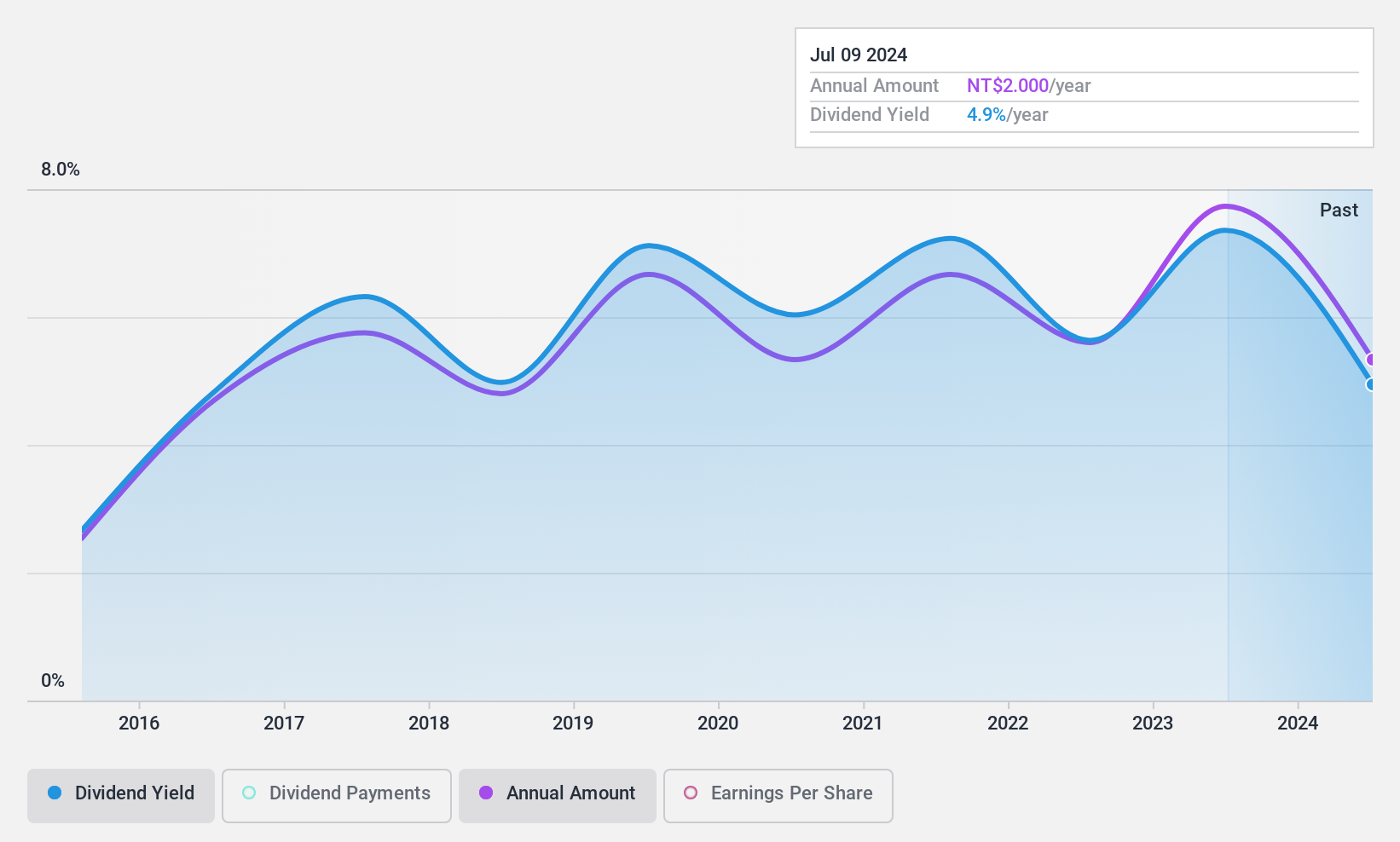

Dividend Yield: 4.9%

King Chou Marine Technology’s dividends, with a yield of 4.88%, rank in the top 25% of Taiwanese dividend payers but have been unreliable and volatile over the past decade, experiencing annual drops over 20%. Despite this, its payout ratio of 50.1% and cash payout ratio of 62.3% suggest dividends are currently covered by earnings and cash flows. Recent Q3 earnings show improved net income at TWD 105.95 million from TWD 86.41 million last year, indicating potential financial resilience.

Simply Wall St Dividend Rating: ★★★★★☆

Xem thêm : Consumer portfolio services sr. vice president sells $27,875 in stock By Investing.com

Overview: Mitsubishi Research Institute, Inc. offers research, consulting, and ICT solutions to both public and private sectors in Japan with a market cap of ¥77.37 billion.

Operations: Mitsubishi Research Institute, Inc. generates revenue through its IT Service segment, which contributes ¥71.37 billion, and its Think Tank Consulting Service segment, which adds ¥45.49 billion.

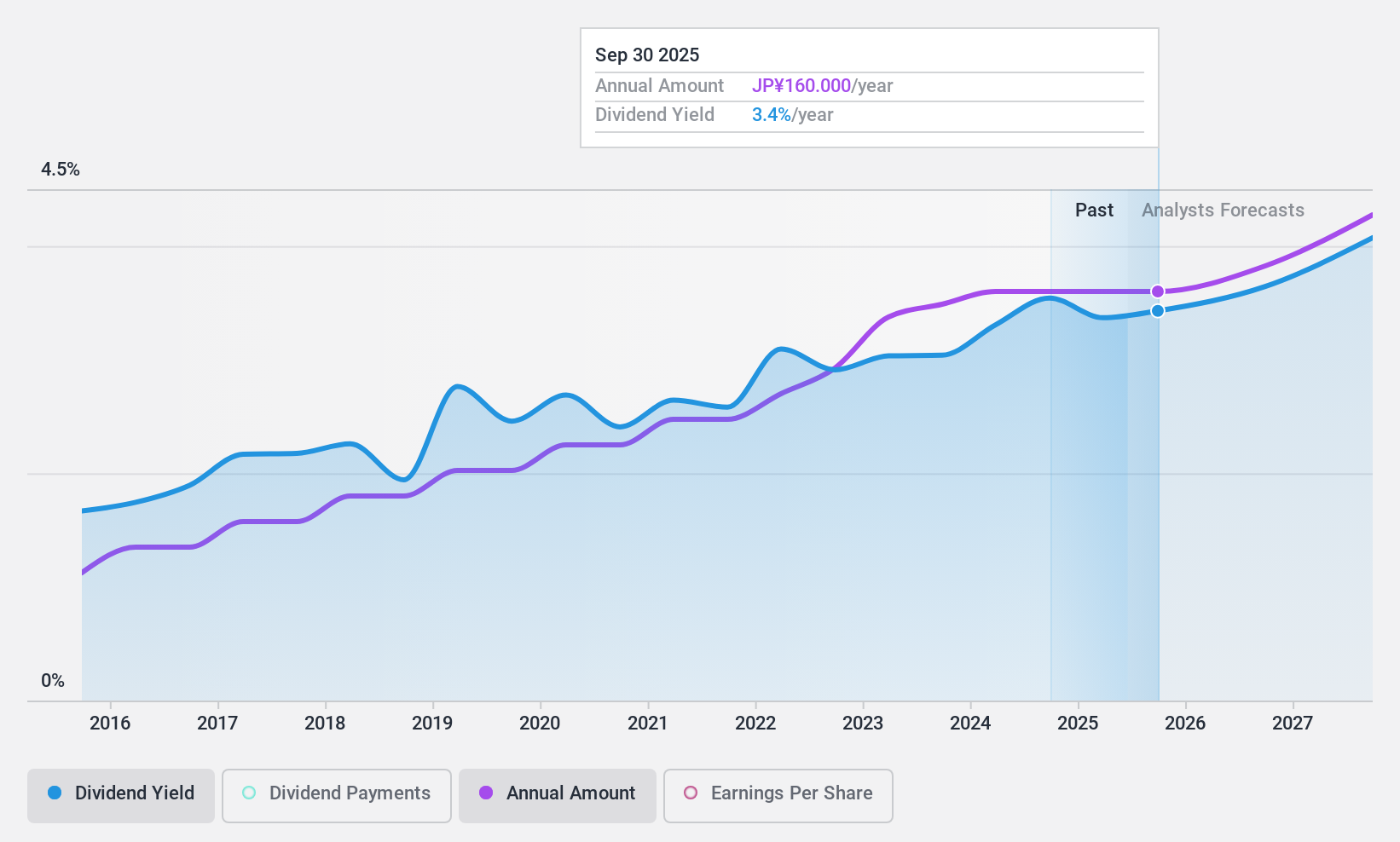

Dividend Yield: 3.3%

Mitsubishi Research Institute’s dividends are well-supported by earnings, with a payout ratio of 50.6%, and cash flows, with a cash payout ratio of 26.8%. Over the past decade, its dividend payments have been stable and growing. Although its yield of 3.26% is below Japan’s top-tier dividend payers, it trades at an attractive value compared to peers and is forecasted for significant earnings growth. Recent strategic alliances may enhance future business prospects.

Taking Advantage

- Click this link to deep-dive into the 2007 companies within our Top Dividend Stocks screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Try a Demo Portfolio for Free

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]

Nguồn: https://earnestmoney.skin

Danh mục: News