What is a Mortgage Lien?

Definition and Purpose

A mortgage lien is a type of voluntary lien that serves as collateral for a mortgage loan. When you take out a mortgage, you voluntarily place a lien on your property to secure the loan. This means that if you fail to repay the loan, the lender has the right to seize and sell your property to recover their investment.

- What is NFT Finance? Market Mechanisms, Infrastructure, and Economic Impact

- Unlocking Growth: Comprehensive Financing Solutions for Consumer Goods Businesses

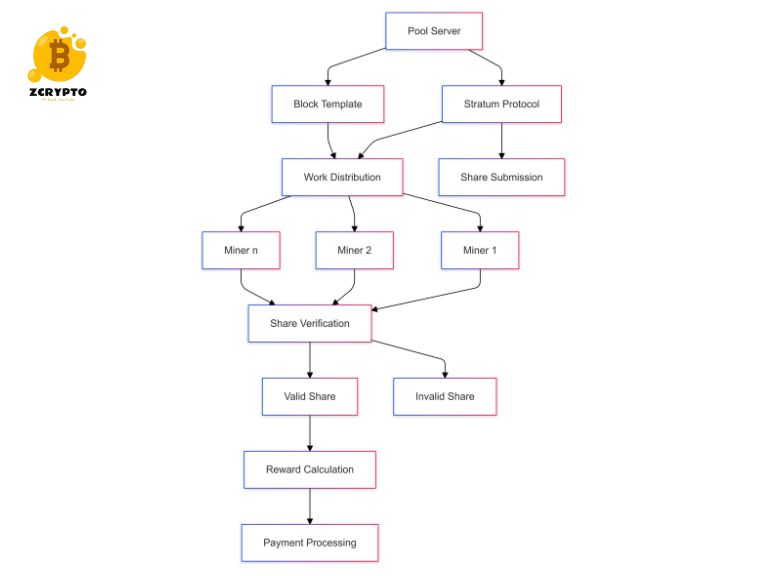

- What is Mining Pool? A Technical Analysis of Collaborative Cryptocurrency Mining

- What is NFT Marketplace? – ZCrypto

- Understanding the Euro Interbank Offered Rate (Euribor): How It Impacts Your Mortgages, Savings, and Investments

The distinction between voluntary and involuntary liens is important. Voluntary liens, such as mortgage liens, are agreed upon by both parties (the borrower and the lender), whereas involuntary liens are imposed without your consent, such as tax liens or judgment liens.

Bạn đang xem: Understanding First Mortgages: Your Guide to Priority Lien, Lower Interest Rates, and Home Financing

Types of Liens

Liens can be categorized into general and specific liens. General liens apply to all of your assets, while specific liens are tied to a particular asset. A mortgage lien falls under the category of specific liens because it is directly associated with the property being mortgaged.

Lien Priority and the First in Time, First in Right Rule

General Principle

The principle of “first in time, first in right” governs lien priority. This means that the first lien recorded against a property takes precedence over subsequent liens. For example, if you have a first mortgage followed by a second mortgage or other types of liens, the first mortgage will be paid off before any other liens in the event of foreclosure.

Exceptions to the Rule

While the “first in time, first in right” rule generally applies, there are exceptions. Certain types of liens can supersede earlier-recorded liens due to their nature or legal status. For instance:

-

Property tax liens often have priority over all other types of liens because they are considered essential for public funding.

-

Special assessment taxes may also take precedence.

-

In some jurisdictions, HOA (Homeowners Association) liens, known as super liens, can have higher priority than earlier-recorded mortgages.

Impact on Foreclosure

In the event of foreclosure, understanding lien priority is crucial because it determines the order in which creditors are paid from the proceeds of the sale. Here’s an example:

- If you have a first mortgage of $200,000 and a second mortgage of $50,000, and your home sells for $250,000 during foreclosure, the lender holding the first mortgage will be paid first ($200,000), followed by any remaining amount going towards the second mortgage ($50,000).

Involuntary Liens and Their Priority

Types of Involuntary Liens

Involuntary liens are imposed without your consent and can significantly impact your financial situation. Common examples include:

-

Tax liens: Resulting from unpaid taxes.

-

Xem thêm : How to Calculate and Reduce Churn Rate: A Guide for Business Growth and Investor Insights

Judgment liens: Arising from court judgments against you.

-

Mechanic’s liens: Filed by contractors or suppliers who have not been paid for their work.

Priority of Involuntary Liens

The priority of involuntary liens varies depending on state laws and the type of lien. For instance:

-

Tax liens usually have high priority regardless of when they were recorded.

-

Judgment liens may have lower priority but can still pose significant risks if not addressed.

Perfecting Lien Position

Importance of Clear Title

Perfecting lien position involves ensuring that there are no outstanding senior liens on your property. This is crucial for both homeowners and investors because it guarantees clear ownership and reduces legal risks.

Steps to Perfect Lien Position

To perfect your lien position:

-

Ensure all senior liens are paid off.

-

Obtain satisfactions of senior liens from previous lenders.

-

Verify that all necessary documents are recorded correctly with local authorities.

Lower Interest Rates and Home Financing

Factors Influencing Interest Rates

Mortgage interest rates are influenced by several factors including:

-

Economic conditions (e.g., inflation rates).

-

Xem thêm : Ultimate Guide to Debentures: Understanding Investment and Risk

Your credit score; better scores often lead to lower interest rates.

-

Loan terms; longer-term loans may have higher interest rates than shorter-term ones.

Impact of Lien Priority on Interest Rates

While lien priority does not directly affect interest rates, it can influence the risk perceived by lenders. For example:

- A property with multiple outstanding liens may be seen as riskier, potentially leading to higher interest rates or stricter loan terms.

Strategies for Securing Lower Interest Rates

To secure lower interest rates:

-

Improve your credit score by maintaining good credit habits.

-

Choose loan terms carefully; sometimes shorter-term loans offer better rates.

-

Shop around for lenders; different banks or financial institutions may offer varying rates based on their assessment of risk.

Additional Resources or Next Steps

For further reading on this topic, consider consulting resources such as:

-

The Federal Reserve’s guide to mortgages

-

Local real estate laws and regulations

-

Financial advisors specializing in real estate investments

Next steps could include reviewing your current mortgage terms, checking for any outstanding liens on your property, or consulting with a financial advisor to optimize your home financing strategy.

Nguồn: https://earnestmoney.skin

Danh mục: Blog